When Presidential Tweets Shake Your 401(k): The Generational Impact of Market Manipulation

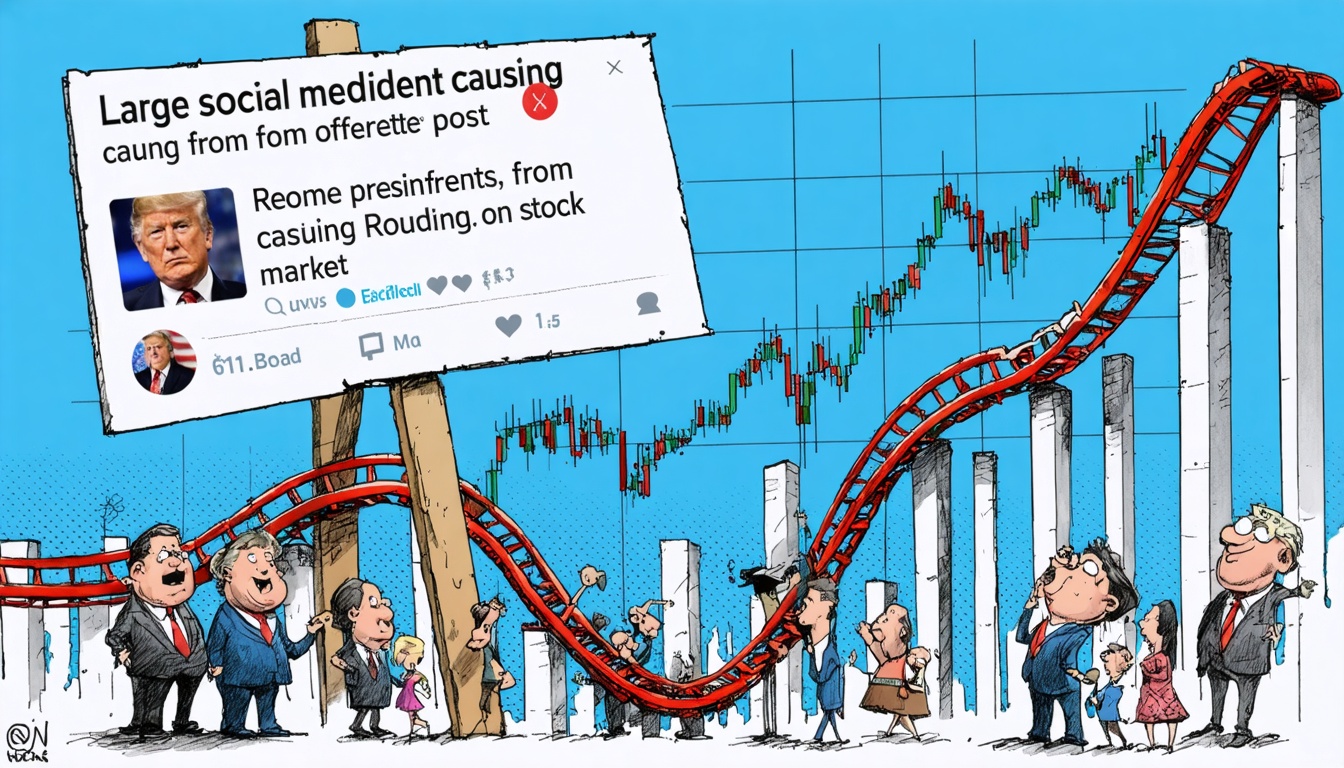

Imagine waking up to find your retirement savings have dramatically shifted overnight, not due to natural market forces, but because of a single social media post from the President. This scenario isn't hypothetical; it's a reality that has unfolded recently, raising pressing questions about the intersection of political actions and market stability.

On April 10, 2025, former President Donald Trump announced a 90-day pause on most of his tariffs, a move that led to a substantial stock market rally. The Dow increased by nearly 8%, the S&P 500 by over 9%, and the Nasdaq by 12%. This sudden policy reversal, communicated just hours after Trump posted market-related advice on his social media platform, has sparked concerns about potential market manipulation and insider trading. Critics argue that such actions could undermine public trust in the fairness and transparency of our financial systems.

Historically, the Securities and Exchange Commission (SEC) has been vigilant in enforcing insider trading laws to maintain market integrity. However, data indicates that under the Trump administration, the SEC brought the fewest number of insider trading cases in decades, raising questions about the effectiveness of regulatory oversight during that period.

The implications of these developments are profound. When political leaders' statements or actions can cause significant market fluctuations, it affects everyone—from retirees relying on their 401(k)s to young professionals investing in their futures. This situation underscores the importance of ethical leadership and robust regulatory frameworks to prevent the misuse of power for personal or political gain.

Understanding how different generations perceive and are impacted by these events is crucial. Each generation brings unique experiences and values to the table, shaping their views on economic stability, trust in institutions, and the role of leadership in market dynamics.

By examining these perspectives, we can foster a more comprehensive dialogue about the responsibilities of our leaders and the safeguards necessary to protect the integrity of our financial systems for all Americans.

Generational Perspectives

Explore how different generations perceive this topic. Click on a generation to expand.

Winners and Losers: Generational Perspectives on Market Manipulation

Each generation perceives the impact of market manipulation differently. Boomers, with substantial investments, may feel their hard-earned savings are at risk. Gen Xers, balancing peak earning years and family responsibilities, might worry about the stability of their financial plans. Millennials and Zoomers, still building wealth, could feel disillusioned by a system that seems rigged against them. Gen Alpha and Gen Beta, though not yet active in the economy, will inherit the long-term consequences of today's actions. Recognizing these varied impacts is essential for fostering empathy and collective action.

Finding Common Ground

Despite differing experiences and viewpoints, all generations share a vested interest in maintaining fair and transparent financial markets. Recognizing this common ground can serve as a foundation for collaborative efforts to ensure ethical leadership and robust regulatory frameworks that protect the economic well-being of all citizens.

Ensuring Market Integrity: A Shared Responsibility

In conclusion, the recent events surrounding presidential influence on market dynamics underscore the critical need for transparency and accountability in leadership. Each generation, from Boomers to Gen Beta, has a stake in the stability and fairness of our economic systems. By fostering open dialogue, advocating for ethical practices, and holding leaders accountable, we can work together to protect the integrity of our markets for current and future generations.

Sources

- "Market manipulation": Democrats scrutinize Trump's posts before tariff retreat by Axios (Apr 10, 2025)

- The Latest: House narrowly passes framework for Trump's big spending bill by Associated Press (Apr 10, 2025)

- In Congress, Trump's Tariff Pullback Sparks Relief, Frustration, and Suspicion by Time (Apr 10, 2025)